Invisible Home Scams

Shield your home investment from invisible scams. Gain insights into real estate fraud prevention, recognize warning signs, and secure your property against deceptive practices. Empower yourself to make informed and secure real estate decisions.

The Invisible Home Improvements scam represents an alternative scheme that garnered a significant number of complaints to the BBB in 2013. According to Smitherman, home improvement scams show little variation from year to year, typically involving subpar craftsmanship by unlicensed or untrained workers. Stay vigilant to protect yourself from these deceptive practices, which often result in shoddy workmanship and financial losses.

Among the most challenging for homeowners to detect, and consequently, the easiest for scammers to pull off, are repairs or enhancements to the areas of your home that are not visible, including roofs, chimneys, air ducts, and crawl spaces.

Scammers may simply knock on your door, offering a fantastic deal because they claim to be "in the neighborhood." However, they are increasingly utilizing telemarketing, email, and even social media to reach homeowners. Stay vigilant and cautious, as scammers employ various tactics to exploit homeowners, especially when it comes to repairs or improvements that may be hidden from plain view.

We offer a Spam Checker Tool for your convenience. You can enter the email or contact number that you suspect might be a scam. This tool checks it against our spam database list to verify whether the email or phone number is legitimate or fraudulent. Use this tool to ensure the authenticity of the provided contact information.

If you have fallen victim to Ghana fraud, please submit the scammer's details here.

The invisible home improvements scam is a prevalent type of fraud perpetrated by scammers. Typically, these scammers target elderly individuals and home-based women who may not possess sufficient knowledge of the tactics employed by fraudsters. They attempt to sell products or services to residents that either hold no value for the buyer, or they employ delaying tactics to extract money during the process.

Some of the Most Common Home Improvement Scams

- Cheap Work from Home Improvement Scams

Special Deal, Today Only, or Left-Over Product

Individuals posing as contractors may approach you, claiming they were just passing through the neighborhood and have leftover materials from a previous job. Cities affected by natural disasters are prime locations for these scammers to offer repairs to damaged homes. They may initiate repair work, but once payment is received, they may not return or provide subpar work. In some cases, they may attempt theft of jewelry, antiques, money, or other valuables while working in your home. Alternatively, they may involve the homeowner in unnecessary repairs.

Tips to Avoid Home Improvement Scams

Established contractors typically have enough business through advertising and referrals, eliminating the need to go door-to-door soliciting work. When seeking repair services, consider recommendations from trusted sources or collaborate with licensed contractors who possess authorized certificates and verified contact information. Additionally, check online for any previously reported complaints to ensure the contractor's reputation is sound.

Home Improvement Loan Scam

Homeowners facing substantial costs for significant home improvements often turn to financial advisors for assistance in obtaining home equity loans or other forms of financing. Unfortunately, unscrupulous contractors target these homeowners, potentially leaving them in significant debt.

How It Works?

A contractor may present an enticing proposal, showcasing a modern redesign for your kitchen or offering to fix a roof at an initially reasonable price. However, if you don't have a budget for the remodel, the contractor may propose to assist by arranging money through a lender. As the work commences, you might be asked to sign numerous papers, some of which are left blank, or be rushed into signing without careful reading. Unbeknownst to you, the papers signed could be home equity loan documents with exorbitant interest rates and fees.

Tips to Protect Yourself

Exercise extra caution when signing papers and carefully review the terms and conditions. Before signing any paperwork, compare loan terms diligently. Refrain from agreeing to a home equity loan if you don't have the financial means to pay monthly installments. Safeguard yourself from unscrupulous lenders by being vigilant for red flags and approaching any deal with a healthy dose of skepticism.

Home improvement scams rank as the third most reported offense in the CFA's 2011 Consumer Complaint Survey Report. Complaints often revolve around incomplete work, poor quality work, or no work at all. Here are some of the schemes employed by scam artists to make a quick buck through problematic home improvements:

Driveway Sealant Scam

Scam artists may persuade you that your driveway requires regular checks and repairs. To address this, they offer to seal your driveway and instruct you not to use it for the next two days. In reality, they use inexpensive materials that wear off in a few months or conduct visible repairs while leaving the unseen repair work untouched before disappearing with your money.

Chimney Repair Scam

This is one of the most commonly employed schemes in home improvement scams. Contractors inspect your chimney and misrepresent the need for repairs, citing concerns about preventing carbon monoxide poisoning or a house fire. They may even show images of damaged chimneys and the potential consequences of delaying repairs.

Hot Tar Roofing Scam

Roofs become vulnerable and often require repairs after hurricanes and other storms. Scam roofers take advantage of victims by quoting high prices for roof repairs. Verifying whether the work is done correctly can be challenging in such cases.

Duct Cleaning and Maintenance Scam

Contractors raise alarms about the presence of dangerous mold in heating and air conditioning ductwork, aiming to scare homeowners. They often use small vacuum cleaners that may not effectively remove or clean the dust. In the worst cases, when the work is not done correctly, it can impact your ventilation system and potentially lead to health problems.

Recommendations to Avoid Scams

When seeking home improvement services, hire a trained contractor with previous work experience or based on recommendations. Avoid relying solely on print or online ads. Always verify whether a certain aspect of your home truly needs repair. If it does, seek a second opinion from a reputable contractor to ensure that the recommended work is genuine and necessary.

Protect Yourself from Invisible Home Improvement Scams

- Refrain from allowing anyone to enter your home for an inspection without prior arrangements. Let them know you will call the company if assistance is needed and avoid granting access to your home.

- Exercise caution if individuals arrive in a truck without a company name or display out-of-state license plates.

- Conduct an online search about the contractor's company, checking ratings, work history, and complaints with the Better Business Bureau (BBB).

- Be skeptical of online ads and printed materials; prioritize recommendations from friends, relatives, and neighbors.

- Obtain price estimates from two or three different companies and compare their proposals before making a decision.

- Secure written details from the contractor outlining the work to be performed, the materials and quantities to be used, start and completion dates, and the total cost. Read the contract thoroughly before signing.

- Withhold payment until the stated work is completed or, if necessary, only pay a substantial amount as an initial deposit. Opt for payment through credit card or check rather than cash.

CASE STUDIES

-

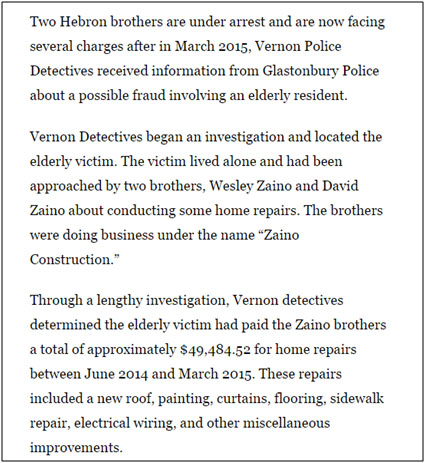

In March 2015, Vernon police arrested Hebron brothers involved in home improvement fraud victimizing

an elderly resident. Police suspect there may be additional victims, and the investigation is

ongoing. The victim alone had been approached by two of these scammers conducting home repairs for

the resident.

repharse and grammer check and also update with new content

-

Mahtab, the convict, faced imprisonment due to numerous complaints filed by various homeowners,

primarily targeting elderly individuals. He consistently postponed the work, providing dubious

excuses on a regular basis. The scammer stands accused of embezzling $250,000 from homeowners under

the guise of invisible home improvements.

This case underscores the deceptive practices employed by scammers in the realm of home improvement

fraud, emphasizing the importance of heightened awareness and caution among homeowners.

-

Stanley Rabner faced sentencing for engaging in federal loan insurance fraud schemes in

Pennsylvania. His typical tactics encompassed overpricing materials and labor, delivering subpar

work, inflating loan interest rates, and more. The scammer's primary objective was to profit by

selling items to individuals who trusted him without conducting proper research.

This case highlights the insidious tactics employed by scammers in federal loan insurance fraud,

emphasizing the need for individuals to exercise diligence and thorough research before engaging in

financial transactions.

-

A collective of high school friends established Ameriquest Mortgage, an entity that orchestrated

fraudulent schemes to extract money from elderly, bankrupt, and indebted homeowners.

-

Two individuals were apprehended by the Lakeland Police Department as they attempted to swindle

$2,700 from an elderly woman. They claimed to be applying silver paint on her roof as a follow-up to

previous work done on the roof.

-

A mother and son duo deceived a widow, absconding with $496,000 from her. Following a guilty plea,

the U.S. District judge mandated that the mother pay $57,828 in restitution to the widow.

Simultaneously, the son received a four-year prison sentence and was directed to pay $223,225 as

compensation.