Cashier's Check Scam

Cashier's check scams prey on the trustworthiness often associated with these bank-issued checks. As online transactions and sales become commonplace, understanding these scams is essential. Learn about common scenarios, signs of a scam, and proactive measures to ensure your financial safety.

WHAT IS CASHIER'S CHECK SCAM ?

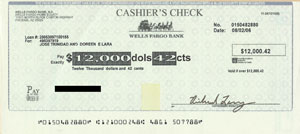

A cashier's check is a type of check issued by a bank or credit union and signed by a cashier or teller.

Because the funds are

drawn directly against the issuing bank's cash reserves, the checks cannot bounce. The cashier's

signature on the checks represents payment guarantee.

We may also receive a cashier's check after closing a deposit account that still has money in it.

Although cashier's checks cannot

bounce, they are nonetheless vulnerable to other dangers such as theft or fraud. And it's not easy to

deal with either problem.

Cashier's checks have a reputation for being safe, and that's what makes them perfect for scams. Whether

you're selling something

online or in-person, cashier's checks deserve extra attention.

SAFETY AND CASHIER'S CHECK FRAUD :

Cashier's checks are considered safe because when they're legitimate, they offer guaranteed funds. Recipients don't have to worry about a personal check bouncing, and money from the check is usually available for spending within one business day. Unfortunately, cashier's checks are much less safe than they used to be. If you don't know and trust your buyer, you simply cannot assume that a cashier's check is just as good as cash.

A TYPICAL CASHIER'S CHECK SCAM :

The most common cashier's check scam goes something like this: A "buyer" wants to purchase a product and will use a cashier's check. For whatever reason, the buyer has a check issued for an amount in excess of the purchase price. Still, the buyer wants the seller to "just go ahead" and deposit the check. Finally, the buyer requests that the seller return the excess money, typically in cash, by wire transfer. The return payment might go directly back to the buyer or to a third party

NOTE THE KEY ELEMENTS :

- The buyer uses a cashier's check or money order. They explain that this is their only option for payment.

- The seller or recipient gets a check for more than they asked for.

- The seller is supposed to send the extra money back to the buyer or to a "helper." If you're faced with a situation that looks anything like this, you're almost certainly dealing with a thief.

- TIMING IS ESSENTIAL : Don't send any money or merchandise until you are 100 percent certain that the paying bank has actually sent the funds. This is often referred to as the time when the check "clears," but that term can be confusing—even for bank employees.

Funds from a cashier's check will be available to you for withdrawal within one business day, but that doesn't mean that the funds actually exist or that they moved to your bank. That process can take several business days or longer. The less you know about your buyer, the longer you should wait.

HOW CASHIER'S CHECK BOUNCE ?

These scams work because everybody believes that cashier's checks are safe. If you use that money (to send it to a "shipper," for example), you may have to replace the funds. Once your bank finds out that the check is bogus, the deposit will be reversed — which could leave you with a negative account balance. With an empty bank account, you'll end up bouncing checks and missing other important payments. What's more, victims of these scams can lose hundreds or thousands of dollars.

PROTECT YOURSELF :

- Take steps to protect yourself from fraud:

- Never accept a check for more than you asked for.

- Verify funds on any check or money order you receive.

- Insist on other forms of payment that you know are more reliable (such as a wire transfer) but be careful about giving out your bank account information.

- Only deal with local buyers on Craigslist and similar sites, and insist on cash payments if you can't go to the bank together.

- Inspect any check you receive, looking for signs that it's a fake. Misspelled words and poor quality paper without any security features are common on fake checks.

- If you must take a check for more than your asking price, inform the seller that you'll wait at least two weeks before sending any money or sending merchandise.

- Speak with a bank manager when you deposit suspect checks. Explain the situation and your concerns, and ask when you can be 100 percent certain that the payment is good. Better yet, don't accept suspect checks

MORE EXAMPLES :

Cashier's checks show up in numerous scams. Keep an eye out for any of the situations below.

-

Money mule : You receive payments, and you're supposed to deposit the payments to your account and

forward the money to somebody else. Often

advertised as a work-at-home check processing job, these schemes are usually problematic. In some

cases, you're laundering money for criminals.

In other cases, the first few payments are fine, but eventually, you'll get a fake check (after

they've gained your trust) and you'll lose money.

- Foreign wealth scams : Somebody you don't know reaches out to you and asks for your help transferring a large sum of money out of a corrupt nation. In exchange, you can keep a tiny fraction of the transfer, which is more money than you make in a year. Of course, you'll have to send money to somebody else to complete the transfer.

-

Inheritance and lottery scams : You won! You're about to receive a lot of money, but you'll need to

pay a small amount for taxes or legal fees

to "release" the funds. It's a small price to pay for the riches that are headed your way. Of

course, they'll never materialize.

-

Property rental scam : Somebody is moving to your area for a new job. They'd like to pay the first

and last month of rent, as well as the

security deposit, with a cashier's check. They have never actually seen the property. The day after

you deposit the check, they say there was

an issue with the job — they're not coming, so they don't need the rental. You can keep the security

deposit, but they'd like for you to return

some of the rent. After you send the refund, you'll find that the check was a fake.