Life Insurance Scams

Protect your financial interests from life insurance scams. Discover how to recognize deceptive practices, identify warning signs, and secure the legitimacy of your insurance policies. Stay informed to prevent becoming a victim of fraudulent activities in the life insurance industry.

How life insurance scam operates?

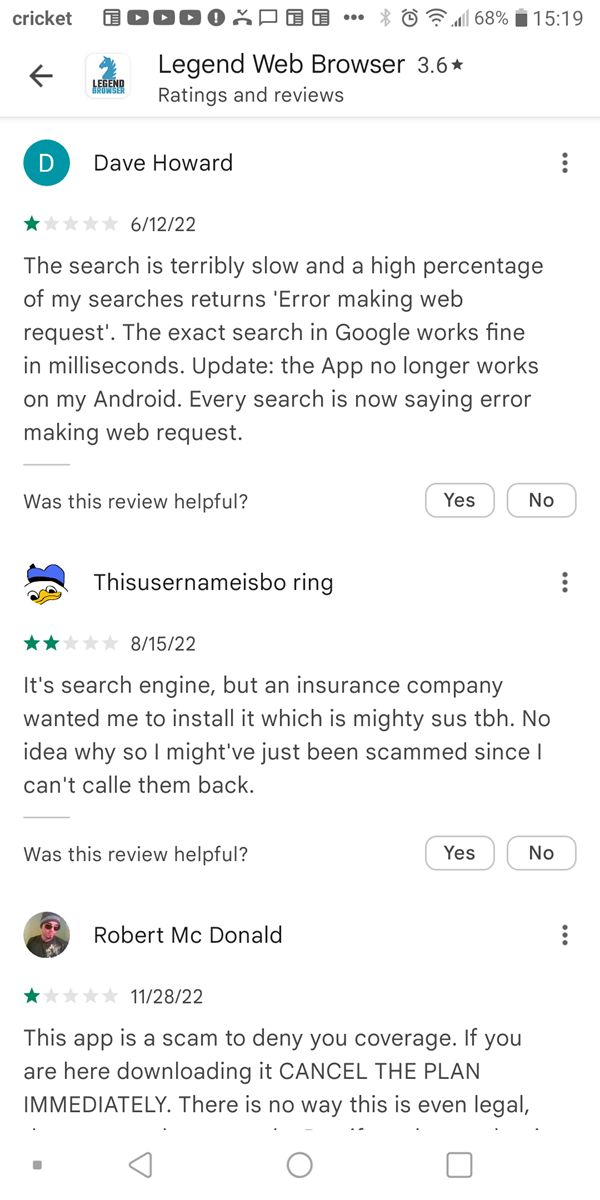

- Fraudulent insurance schemes: Some deceitful individuals or entities may create fake insurance policies, imitating the name of a legitimate insurance company or agent. Despite the appearance of professionalism, these policies hold no actual value, and unsuspecting individuals may end up losing significant amounts of money.

- Premium theft: Dishonest insurance agents may engage in the misappropriation of premiums. Instead of forwarding the premium payments to the legitimate insurer, these agents divert the funds to their personal accounts, putting policyholders at risk of financial loss.

- Churning practices: Unscrupulous insurance agents may employ churning tactics, convincing policyholders, especially vulnerable seniors, to switch to a supposedly superior policy. However, these policies often come at a higher cost without providing any substantial additional benefits. In some cases, agents may inflate an applicant's net worth to push a particular policy. Stay vigilant to avoid falling victim to such unethical practices.

- Scammers exploit a particularly distressing situation by monitoring obituaries for potential targets. In this scheme, a stranger, posing as a life insurance agent, contacts you with the startling claim that your deceased spouse had purchased a life insurance policy worth a substantial amount, often in thousands or millions of dollars. They insist that your spouse wanted this information to be kept a secret. However, a significant issue arises—the final premium payment is allegedly due, and the policy is on the brink of lapsing. The scammer asserts that making this final payment is crucial to save the policy, ensuring that the insurer disburses the maturity amount. To add to the deception, they propose wiring the money to a specified account, which is intentionally made untraceable. Exploiting the vulnerability of grieving spouses, these scammers present seemingly convenient payment options, such as sending cash, using gift cards, or making a credit card payment over the phone. It's a ruthless ploy that preys on individuals during a time of personal turmoil. Stay alert to these deceitful practices involving bogus life insurers and policies that emerge when your guard may be down.

However, complaints lodged against life insurance companies don't solely revolve around outright scams. They also encompass instances of poor advice that leads to financial ruin for the client. This involves promoting insurance products that are not suitable for the individual. Opting for an ill-suited life insurance policy can result in higher commissions and, ultimately, financial bankruptcy. It is crucial to be cautious about advice received and thoroughly assess the suitability of any life insurance product recommended to avoid falling victim to financial pitfalls.

Red flags

The allure of a potentially significant payout makes life insurance an attractive prospect, but it has also become a tool in the hands of the unscrupulous. Here are some red flags related to life insurance that you need to be aware of: If you are being pressured to purchase dubious insurance policies, be cautious! Insurance fraudsters have their own missions, and the volume and quality of the data they compile can vary significantly. Be on guard, as with anything related to insurance. Fraud may take the form of annuities or other variations. In many cases, victims only realize they've been scammed after the perpetrator has disappeared with the loot. Therefore, it is wise to exercise caution as you sign up for any life insurance policy, given that fraudsters employ quite an impressive array of tactics.

If you become a victim of an insurance scam, don't hesitate to contact the appropriate law enforcement agencies—local, state, and federal. Many state departments have a fraud investigation unit that can provide guidance and support.

Life Insurance Scams: Protecting Yourself from Deceptive Practices

Life insurance is a crucial financial tool designed to provide financial security to your loved ones in the event of your passing. However, like any industry, it is not immune to fraudulent activities. Scammers often target individuals with enticing offers, deceptive policies, and manipulative tactics to exploit their vulnerability. Here are some common life insurance scams and tips on how to protect yourself

1. Phony Insurance Schemes

Scammers may create fake insurance policies or impersonate legitimate insurance companies to sell policies that are essentially worthless. Be cautious of unsolicited offers and always verify the legitimacy of the insurance provider before making any commitments. Check for proper licensing and contact information.

2. Premium Theft

Unscrupulous insurance agents may divert premium payments intended for the insurer into their own accounts. Always make premium payments directly to the insurance company through secure channels. Verify payment details and avoid making payments to individuals or unauthorized accounts.

3. Churning

Churning involves unethical agents convincing policyholders to replace their existing policies with supposedly better ones. This can result in higher costs and may not provide any additional benefits. Always carefully review policy changes and consult with a trusted financial advisor before making any decisions.

4. Obituary Scams

Fraudsters monitor obituaries and contact grieving individuals, claiming that the deceased had a life insurance policy. They request immediate payments to prevent policy from lapsing. Verify any such claims directly with the deceased's insurance company and never make payments to unknown individuals.

5. Unsuitable Insurance Products

Some scams involve pushing insurance products that are not suitable for the individual's needs. Avoid high-pressure sales tactics and carefully assess whether the proposed policy aligns with your financial goals. Seek advice from independent financial experts if needed.

6. Junk Insurance Policies

Be wary of scams promoting so-called "junk" insurance policies. If an offer seems too good to be true, it probably is. Thoroughly read all offer documents, and don't rely solely on the information provided by the seller. Conduct independent research and consult with professionals.

Remember, staying informed and exercising caution are essential in safeguarding yourself from life insurance scams. If you suspect fraudulent activity, report it to the relevant authorities immediately to prevent further harm.