New Tax Office Phishing Scams

Guard yourself against the surge in new tax office phishing scams designed to deceive individuals during tax season. Recognize the warning signs of fraudulent emails posing as tax authorities and fortify your online security to prevent falling victim to financial fraud. Stay informed, stay secure.

Stealthy Money Theft by Scammers

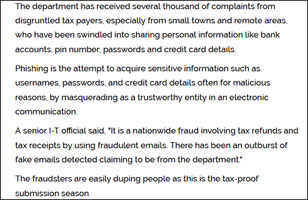

Operating from various countries, scammers employ diverse tactics to swindle the hard-earned money of unsuspecting individuals and businessmen. Recent incidents have seen numerous people falling victim to these fraudsters, with some scams gaining widespread attention. The scammers initiate phishing campaigns, sending deceptive emails to thousands of recipients, urging them to disclose personal and financial information, including bank account details and internet passwords. Unfortunately, some individuals, unaware of the scam, respond with the requested information. The scammers then exploit these details on banking websites, orchestrating large-scale thefts from both corporate entities and individuals.

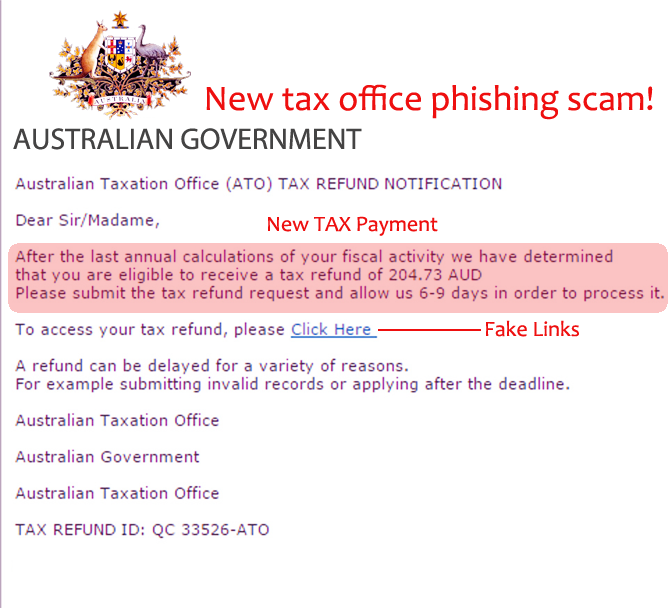

Beware of the New Tax Office Phishing Scam

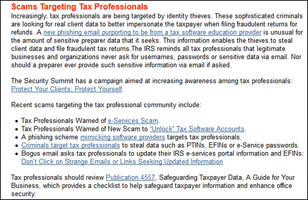

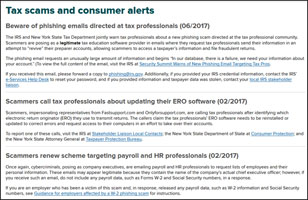

A prevalent scam making headlines is the New Tax Office Phishing Scam, where perpetrators impersonate tax authorities or officials. Victims receive well-crafted emails requesting substantial payments along with the provision of passwords and other sensitive personal information. Innocent recipients often fall prey to these scams, unknowingly providing the requested details. Within minutes of receiving the email, scammers clandestinely siphon off the entire amount, leaving victims in shock. Despite such scams becoming increasingly common, only a few people are aware of these fraudulent activities. It is crucial for businesses and corporations to stay informed by regularly checking the official tax authority website for updates on prevalent scams. Vigilance is key, and individuals should refrain from sharing vital information, such as internet user IDs and passwords. The income tax and revenue officials are taking stringent actions against scammers; however, their numbers continue to grow globally. Taxpayers receiving phishing emails should promptly report the matter to revenue officials or cybercrime authorities. Exercise caution during email transactions and avoid disclosing crucial financial details to strangers who may pose as responsible figures from governmental or financial agencies, attempting to steal individuals' data. Think wisely and refrain from sharing financial matters with strangers to prevent immediate loss of funds.

The Ongoing Challenge for Income Tax Authorities

Income tax authorities have encountered numerous intriguing cases in the past and are likely to face more as scammers continuously develop intelligent strategies to swindle money from unsuspecting customers. The challenges ahead demand heightened seriousness from the authorities concerned. Customers receiving new tax office phishing scams should not passively observe; instead, they must take proactive measures to bring these fraudulent actors to the court of law.

Unveiling the New Tax Office Phishing Scam Tactics

The new tax office phishing scam is a sophisticated scheme wherein perpetrators masquerade as tax authorities or officials. They send carefully crafted emails to taxpayers, urging them to deposit a substantial sum into a specified account while also soliciting sensitive information, including passwords. Unfortunately, individuals who receive these emails often fall prey to the scam, unknowingly providing the requested details. Within moments, the scammers siphon off the entire amount without the victim's knowledge. These scams are gaining notoriety, yet many remain unaware as they often go unreported in mainstream news. Businesses and individuals are advised to stay vigilant, regularly check official tax authority websites for updates on scam activities, and refrain from disclosing critical information such as internet user IDs and passwords. The increase in the number of scammers worldwide signals a growing threat, necessitating heightened caution when conducting financial transactions through emails.