Affinity Scam

Scammers leave no stone unturned to pitch out money from innocent individuals who are not aware of fraudsters

who exist only to swindle money. One such type of scam is the affinity scam. This scam is related to money,

investments and financial instruments.

Everything you need to know about affinity fraud. Who, what, when, where and why of affinity scam!

Who are affinity fraudsters?

A group of individuals may come together to establish a small investment company, specifically targeting vulnerable populations susceptible to affinity fraud. However, those committing affinity fraud aren't always groups; they can also masquerade as fake investment banks, sham stock broking firms, or deceptive stock brokers.

What does "affinity scam" mean?

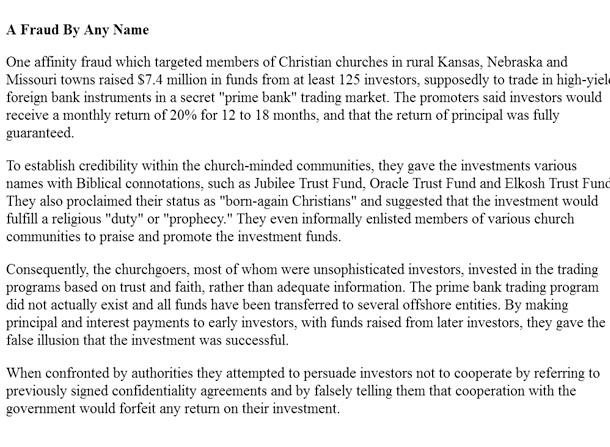

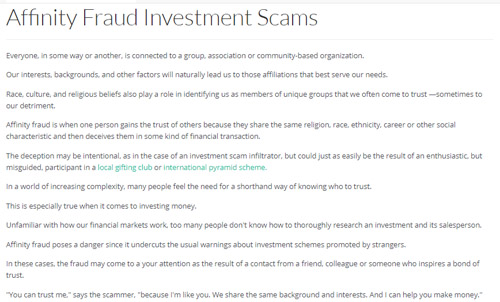

An affinity scam is a type of investment fraud in which the fraudster presents a bogus investment opportunity or financial plan, promising substantial returns in a short period. These scammers deceive unsuspecting individuals into investing in schemes, securities, or other financial instruments by providing misleading information that investors rely upon to make their decisions.

When was the most severe penalty imposed for an affinity scam?

One of the most significant affinity scams in history unfolded in late 2008. The individual behind this scam defrauded investors of $65 billion using a counterfeit Ponzi scheme. Widely referred to as the "Madoff investment scandal", this fraudulent operation involved stock and securities manipulation. The scammer provided investors with fabricated balance sheets that falsely indicated their investments were thriving. However, when the market took a downturn and investors began withdrawing their funds, Madoff couldn't deliver the promised returns. As a result of his actions, he was sentenced to 150 years in prison and ordered to pay $170 billion in restitution.

Where do you find maximum cases of affinity fraud?

Affinity fraud is a deceptive practice that exploits the trust inherent within specific groups or communities. Typically, the fraudster is, or feigns to be, a member of the targeted group, leveraging this insider status to promote misleading or fake investment opportunities with promises of high returns. Such scams are particularly prevalent in close-knit communities, whether religious, ethnic, or professional. For instance, Utah, with its strong religious ties, has been identified as a hotspot for such frauds in the U.S. The cornerstone of affinity fraud is the manipulation of trust, emphasizing the importance of skepticism and due diligence in any investment decision.

Why do fraudsters indulge in affinity fraud?

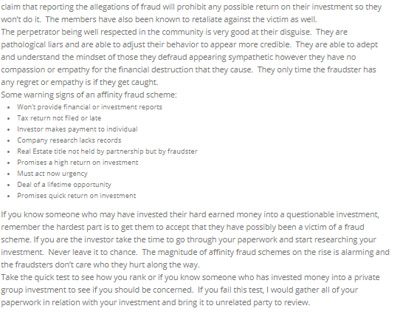

Fraudsters are drawn to affinity fraud due to the ease of exploiting trust within close-knit communities. By positioning themselves as members or allies of a specific group, they can quickly gain credibility. This intrinsic trust diminishes skepticism, making members more susceptible to "exclusive" investment pitches. Furthermore, being within or familiar with the community allows scammers to customize their tactics, enhancing their persuasiveness. Additionally, as initial members buy into the scam, their endorsement can lead to a chain reaction, drawing more victims in. The communal loyalty often means less external scrutiny, as members rely more on word-of-mouth than objective verification. Thus, the strengths of tight-knit communities, like trust and mutual respect, inadvertently become vulnerabilities in the face of affinity fraud.

How to Safeguard Against Affinity Fraud

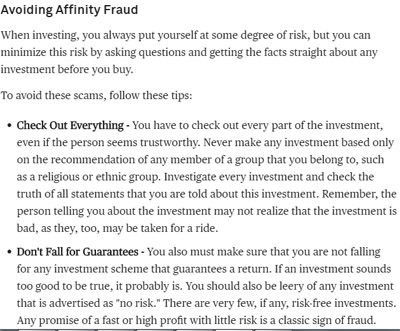

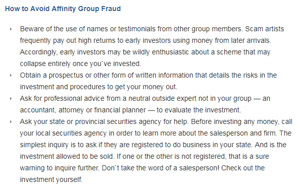

- Always approach investment opportunities with skepticism. If an offer seems too good to be true, it often is. Trust your instincts and be wary of seemingly outsized returns.

- Remember, all investments carry risks. Be cautious of anyone promising "guaranteed" returns, as this is a common red flag.

- Insist on receiving written documentation about any investment. Verbal agreements or assurances aren't enough; having detailed records is essential for your protection.

- Be wary of high-pressure sales tactics or "limited-time offers." Genuine investment opportunities won't rush you to make decisions without proper evaluation.

- Don't automatically trust unsolicited emails, messages, or phone calls promoting investment opportunities. Always do your due diligence by researching the company and arranging face-to-face meetings when possible.

- Avoid schemes that prioritize or necessitate recruitment of new investors. These are hallmark characteristics of Ponzi or pyramid schemes, which are designed primarily to defraud participants.

- Prior to investing, thoroughly research all parties involved, whether it's an individual, firm, broker, or any organization offering the scheme. Informed decisions are your best defense against fraud.