Investment Scams

These are schemes cleverly designed to trick people out of their money by promising high returns on an investment. Investment scams are promoted on the internet. Fake and dodgy share schemes are marketed by telephone salespeople with high pressure and sophisticated selling techniques. Sometimes investment scams are promoted within groups of people with common interests. Investments scams come in various forms but they have common characteristics. Case studies showing how financial advisors try to cheat elderly people off their principal amount and 25 Government and Education based sites have been listed for reference purpose.

Cautions:

The higher the promised rate of return, the greater the risk, and the more you should investigate.

Beware of schemes which

- Promise very high returns with little risk - these promises are too good to be true.

- Give little information in writing - all legitimate investments must have documents that explain the investment.

- Claim to be "safe" or "risk-free" - all investments have some degree of risk have no Investment Statement or Registered Prospectus.

- Give few or no details about the person or company making the offer.

- Have no Investment Statement, Registered Prospectus, or financial statements.

Beware of offers which claim that

- You must take up the offer immediately or you'll miss the opportunity - legitimate companies don't pressurize people to act without time to look into the deal.

- Returns come from the "top 100 world banks", "prime banks", "top 25 European banks" or similar statements - these agencies do not exist.

- This is a "private" offer, and only open to a select few.

- The scheme must be kept confidential in order to succeed.

DID YOU KNOW? - About Investment Scam:

- The first Ponzi schemes were set up by Boston fraudster Charles Ponzi in the 1920s.

- 27% of Canadians believe they have been approached with a possible investment scam at some point in their life.

- Each year more than 38 million people fall victim to Investment scams, the most popular being the Ponzi scheme.

- The highest recorded loss in investment scam amount to $100 billion.

- Despite tougher laws, investigators reports Americans are losing as much as $40 billion a year to investment fraud. One of the biggest schemes running right now is the promissory note scam.

List of types of Investment Scams:

- Advance Fee Scheme

- Affinity Scam

- Annuities

- Commodity Pool Fraud

- Exempt Securities Scam

- Forex Scam

- High yield investment scheme fraud

- Internet and social media fraud

- Investment seminars

- Lending loan scams

- Microcap fraud

- Off shore investing scam

- Pension scam

- Ponzi / pyramid scheme

- Pre IPO investment schemes

- Precious metals investment scam

- Prime Bank scam

- Promissory notes

- Pump and dump scam

- Unregistered investments

Advance Fee Scheme:

In advance fee scheme, the victim is persuaded to pay the amount in advance in order to avail a special benefit from the investment. Scammers usually call these "advance fee" as security deposits that will be returned on the maturity of investment. But in the end the victim realizes that neither the investment is going to return nor the security deposit.

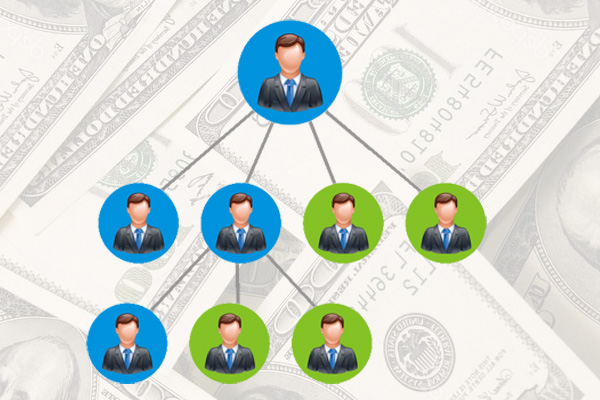

Affinity Scam:

Affinity scam is similar to Ponzi/pyramid scam where the new investor's money is used to pay the interest of old investors. In affinity scam the scammers often target a homogeneous group of people such as the elderly. The scammers involved in affinity scam are often a group of people who spread the word about the investment scheme. The aim of scammers in this type of investment fraud is to convince all the members of the group to invest in order to build a tight-knit structure. Once the investment is made, the scammers exploit the investor's money and disappear leaving no trace.

Annuities:

Annuity is another area where investment scam build is base. The scheme is simple where the scammers induce the elderly to invest the amount for a long time gap which will yield excellent interest rates. The scammers get the investment money and the investor is forced to believe that the amount is in investment for a stipulated period of time. But during the end of the time there is no sign of the investment made years earlier.

Commodity Pool Fraud:

Commodity pool fraud usually involves individuals and firms that are not registered. They offer investments to victims in various commodity pools. The money that is invested in such pools is often misused. The investors are given false claims of high profits and low risk of investments in the commodity pools.

Exempt Securities Scam:

When a registered company sells its securities, they issue a prospectus with securities regulators. Companies that do not issue prospectus are termed as "exempted securities" and they are an exception. Not all exempt securities companies are fraud. But the suspect on such companies is higher. Investment scammers pitch investment securities as exceptions companies and promise heavy returns on investments. These companies design the securities issue that motivates the victim to invest.

Forex Scam:

One of the most unpredictable investment scam is the Forex scam. The Forex market is one of the largest financial markets in the world, and is more vulnerable for investment scams. Investors try to earn by selling and buying foreign currencies by change in exchange rates. Fraudsters try to promote their exchange agency as legitimate one. Unregulated firms market their service online, and make you deposit your money off shore which will become inaccessible by you when you realize that the agency is fraud and not legitimate. It is extremely difficult to find beat the professionals who design Forex sites that appear to be legitimate.

High yield investment scheme fraud

High yield investment schemes are a part of the internet that will run attractive websites over the internet with alluring rates of interest like 25 to 35% (monthly or yearly) in order to induce the victims to invest money. These websites that run such investment schemes are usually run by unregistered and unlicensed individuals. Investors must be very careful when come across any such scheme over the internet.

Internet and social media fraud

Internet and the growing technologies have given scammers a new arena to target victims for investment. It helps scammers cover a mass audience at a very low cost and minimum effort. They make use of tools and websites that lure the investors and make it difficult for them to differentiate between the legitimate and fraud schemes. The major sources for internet fraud are social media websites, online newsletters and even spam emails. It makes it easy for the scammer to approach the target via such mediums and difficult for the victims to judge the legitimacy of the sources.

Investment seminars

Most of the investment seminars are a scam because if the investment would be really yielding returns, then the people who were running the seminars would be profiting from it rather than calling for more investments. These seminars aim promote to get rich quick schemes that lure the target audience to invest their money. Investment seminars intend to get more audience from referrals.

Lending loan scams

Lending loan investment schemes are not trust-worthy as the investor is not aware that the money that is invested as a lending loan amount in really invested on a credit worthy loan or is just a fake investment plan. The investing company may send reports every month stating the returns that you loan amount is earning, but at the maturity period the victim realizes that the loan amount was not lent and the amount has become subject to investment fraud.

Microcap fraud

Microcap fraud deals with the investments made in the stocks of a company. Fraudsters spread false information about low-priced stocks. Investors are given manipulative prices of microcap stocks as microcap stocks are less liquid than other stocks of the company. Microcap fraud occurs usually occurs when the scammer invites investment for unsolicited stocks, or suddenly explains an increase in the stock prices of the company. The aim of fraudsters in microcap fraud is to create profit from your investment.

Off shore investing scam:

In Off shore investing scam, the scammer promises huge profits to the victim if they agree to send their money off shore to another country. The investment scammer lures you by mentioning lower or no tax rates at all thus making you fall prey to their scam. In reality, there are a lot of risks involved in sending the money off shore to another country. Things can go wrong any minute and you will end up paying penalties to their government and the fraudsters would have escaped by then. Off shore investment schemes are dangerous and more vulnerable to scam.

Pension scam:

The Pension scam is often targeted at senior citizens. The targets of these scammers are often people who have retirement savings in a Locked-In-Retirement Account (LIRA). This scam is often promoted through media sources like Newspaper with attractive advertisements that tap you into locked in funds. In order to invest in these funds they require you to sell the LIRA money to buy the shares of the new start-up company. The promoters say that the money you withdraw will be non-taxable and you will receive interest for the money you have invested. But once the formalities are over, the promoters are no more there and so is your LIRA money.

Ponzi / pyramid scheme:

In Ponzi or pyramid scheme, the scammers build the investment pyramid with the investor's money and pay the same money as a result of quick returns in the form of 'interest cheques. Investors get carried away by the sudden return on investment and refer friends and family and reinvest their money. The interest cheques are nothing but their own money and money invested by new investors. Eventually new investors stop investing and there is no money left with the scammers to pay as interest and that's when these fraudsters will vanish making you a subject to investment scam.

Pre IPO investment schemes:

Pre IPO (initial public offering) schemes are those where the fraudster offer stocks of a certain company prior to the initial public offering which is not legal. They lure the investors by making them believe that they are a part of the company and that the investment would reap excellent returns. Such pre IPO scams are promoted through social media, cold calling, emails, or by sales person.

Precious metals investment scam

Precious metals investment scam is one where the investors are given tricky promises about high returns from investments in precious metals like gold, silver, platinum etc. these fraudsters call themselves as metal dealers. They make you believe that there are huge investments in such metals and that there is going to be a huge hike in the market in the price of such metals. Fraudsters are becoming more and more proficient in making the victims fall subject to precious metals investment scam.

Prime Bank Scam

The term "Prime Bank" usually refers to the top 50 banks in the world. These banks generally trade high quality and low risk instruments. But these days this term is used by fraudsters in order to induce investors to invest their hard earned money. They claim that this money will be invested in trading prime bank financial instruments and safe security deposits that will return huge gains. But unfortunately in the end, these scammers elope with the money and the victim is made subject to "prime bank" investment scam.

Promissory notes

Promissory notes are sometimes a form of debt that some companies use to raise money as a form of capital. They typically target investors loaning lump sum amounts to the company in exchange for a fixed amount of income and interest on the amount as a whole. The aim of scammers is to bring in money in huge amounts and then leave no trace of the company or the promissory notes making the investors subject to investment scam. The targets of most scammers for this type of investment scam are elderly people or people in the late retirement stages.

Pump and dump scam

In pump and dump scam, investment scammers' work through lists of potential investors to promote a deal on a low-priced stocks. The scammer contacting you also owns a large amount of this stock and the stock may not represent a legitimate business. As more and more investors buy shares, the value of the stock rises sharply. Once the price hits a peak (which the scammer knows), the scammer sells their shares and the value of the stock plummets drastically. You're left holding worthless stocks that are worth dump and you thus end up in becoming a victim of investment scam. Thus the name "pump and dump" scam.

Unregistered investments

Unregistered investments are those where scammers create fraud companies with fake registered documents and release the stocks at a minimal price. Investors are made to believe that the company is a legitimate one, and are directed towards buying the stocks. The money pooled in from various investors is taken by the scammers leaving no trace of the company.

Types:

Protect Your Investment

Investment scams

Internet and Social media fraud

Huffingtonpost

Feel Free to use our Spam Checker Tool

We are providing a Spam

Checker Tool for your convenience. Here you can enter an email address or a contact number that

you suspect to be a scam. This tool checks it with our spam database list and ensures you whether the

email or the phone number is real or a bogus one.

Report scam to United States

government-you could file a complaint about scam or other crime here.