Prime Bank Scams

Discover the nuances of Prime Bank Scams and shield yourself from financial fraud. Uncover deceptive investment practices and stay vigilant against unscrupulous banking schemes. Navigate the realm of white-collar crimes with insights to safeguard your financial well-being.

The constant emergence of various scams, making daily headlines, subjects the public to significant hardship, instilling fear and panic. Concerned customers, who entrust their confidential information on websites, are anxious about their safety and security, as scammers employ clever tactics to exploit their finances through diverse methods.

These individuals, operating from undisclosed locations under various aliases, meticulously plan their schemes. They target not only the affluent but also the financially struggling commoners. Disguised as salesmen, marketing executives, and managers, these scammers infiltrate the homes of ordinary people, surreptitiously siphoning off their hard-earned money without their knowledge.

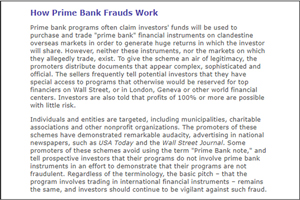

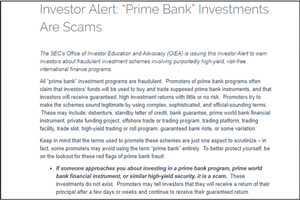

Scams related to prime bank guarantees are a fascinating topic in the realm of fraudulent activities, worthy of exploration and documentation. In this unique scam, the perpetrators incite interest among their target group, enticing them to invest their hard-earned money in various "bank guarantee funds" that promise extraordinary returns ranging from 30% to 200%. They assert that this is a risk-free investment and that the funds will be secure in the hands of reputable banks. However, this is a deceptive ploy with no actual existence of prime bank investment funds. Unsuspecting individuals, fueled by high expectations, deposit significant sums, only to discover that the fraudsters, operating from distant locations, vanish with the money, never to be seen again.

The letters, emails, phone calls, and other elaborate methods employed by scammers are exceptionally official and error-free. When recipients respond to their communications, scammers exert maximum pressure, urging them to invest their money in government-sponsored funds that, in reality, do not exist.

If the commoner deposits the money, the scammer will promptly swindle it. The letters or emails will contain sophisticated and complex sentences, appearing extremely legitimate. The correspondence will request individuals to invest money in government-sponsored debentures, shares, and other portfolios that, in reality, do not exist. Scammers will also send numerous emails, urging the audience to invest in prime bank trading program funds that, in reality, never exist. If an innocent person deposits the money, it will be swiftly swindled. The general public should avoid interacting with these types of scammers who send emails with the sole intention of siphoning off their money.

The below mentioned guidelines will be of great help to the public:

- Since there is no such thing as prime bank guarantee funds, individuals who receive these types of emails can instantly delete them.

- Never reply or encourage scammers by responding to their emails.

- Cross check with others whether they are also receiving this type of scamming mails.

- Cross-check with others to see if they are also receiving this type of scamming emails.

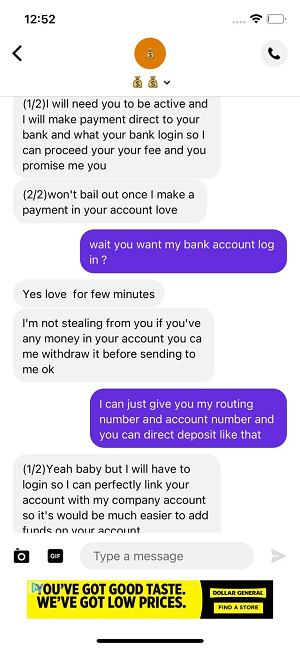

- Never share your personal, financial, credit card, and bank-related information with third parties or unknown entities.

- Escalate this matter to cyber patrolling experts or the police.

Unraveling Prime Bank Scams: A Closer Look at the Sophisticated Schemes

Prime bank scams have evolved into sophisticated schemes that prey on the unsuspecting public, exploiting their financial aspirations and trust. Scammers, often operating from undisclosed locations under various aliases, meticulously plan and execute fraudulent activities targeting not only the affluent but also ordinary individuals facing financial difficulties.

One intriguing facet of prime bank guarantee scams involves the enticement of potential victims to invest their hard-earned money in nonexistent "bank guarantee funds." The scammers promise extraordinary returns ranging from 30% to 200%, presenting the investment as risk-free and secure within the confines of reputable banks. However, the reality is that there is no such thing as a prime bank investment fund. Once the unsuspecting victims deposit their funds, the scammers vanish, leaving behind shattered financial dreams.

The communication methods employed by prime bank scammers are often highly official and meticulously crafted to appear error-free. Letters, emails, and phone calls adopt a veneer of legitimacy, creating an illusion that the proposed investments are government-sponsored and entirely credible. The scammers exert maximum pressure on recipients, coercing them to invest in fictitious government-backed debentures, shares, and portfolios.

Preventive Measures Against Prime Bank Scams

- Awareness: Recognize the signs of prime bank scams and be skeptical of unsolicited investment opportunities.

- Verification: Cross-check with others to validate the authenticity of received communications and verify the existence of proposed investment avenues.

- Privacy: Never share personal, financial, credit card, or bank-related information with unknown entities or third parties.

- Non-Engagement: Refrain from responding to scam emails or encouraging scammers by engaging in correspondence.

- Reporting: Report instances of prime bank scams to cyber patrolling experts or law enforcement agencies to contribute to the prevention of such fraudulent activities.