Plastic Card Scams

Guard against plastic card scams and credit card fraud with our comprehensive guide. Explore the risks of card skimming, identity theft, and cloning. Learn valuable tips to enhance your financial security and protect against fraudulent transactions. Stay one step ahead to ensure the safety of your plastic cards and online payments.

Plastic Card Scams:

Changing technology has revolutionized the way we make payments. While cards have undoubtedly made our lives more convenient, providing access to online shopping and

reducing our reliance on physical currency, it's crucial to be aware that plastic card scams are on the rise.

Changing technology has revolutionized the way we make payments. While cards have undoubtedly made our lives more convenient, providing access to online shopping and

reducing our reliance on physical currency, it's crucial to be aware that plastic card scams are on the rise.

Surprisingly, an increasing number of individuals find themselves falling victim to plastic card fraud each year. In fact, according to a 2015 research note, the U.S.

is responsible for 47% of the world's card fraud, despite only representing 24% of the global population. This highlights the pressing need for vigilance and understanding

of the evolving landscape of financial security.

overall universal card volume. Having a great impact on other countries, among U.K.-issued cards in 2015, 35% of plastic card con losses happened in the United States, compared to 10 percent in France and Australia, 9 percent in Canada and 6 percent in Germany.

However, this technological advancement has also opened the door to cross-border scams. Such scams occur when perpetrators conduct fraudulent transactions in another country using consumers' debit or credit cards. Many scammers operating from distant countries employ sophisticated tactics to exploit unsuspecting individuals. A 2014 report revealed that approximately 47% of fraudulent cross-border transactions on U.K. credit cards took place in the United States.

What is even more concerning is the increasing prevalence of plastic card scams in the U.S., as indicated by the 2013 report. In 2014, around 31.8 million U.S. consumers

experienced credit card fraud, a number more than three times higher than the previous year. The consequences are not trivial; nearly 90% of card fraud victims in 2014 received

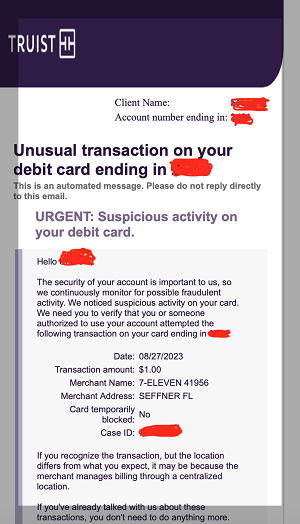

replacement credit cards, costing issuers approximately $12.75 per card. According to the report, fraud attempts were primarily initiated by phone (54%) and email (23%), with

mobile transactions accounting for 14% of the total transaction volume.

In the era of all-encompassing payment options, where all your payment cards can be consolidated into a single sophisticated device, it's essential to be aware that

scams can still occur with this all-in-one card. As trends evolve, so do the tactics of fraudsters. Stay informed about the upcoming trends in plastic card fraud

insurance to better prepare for potential threats in the near future.

With cunning con artists constantly devising new ways to exploit and take advantage of your hard-earned money, it's crucial to stay updated on prevention methods. Outsmart these

criminals and don't give them an opportunity to execute their schemes. Remain vigilant and proactive in safeguarding your financial assets!

Adapting to Change: The Dynamic Landscape of Plastic Card Fraud Detection Tools

Fraud detection tools play a crucial role in providing robust security and risk mitigation solutions in our ever-evolving world. These tools are designed to detect

key elements associated with various types of fraudulent activities. However, the performance standards for plastic card fraud detection tools are continually evolving

due to the growth and diversification of fraudulent activities.

To effectively address the dynamic and emerging nature of scam activities, fraud detection tools and techniques must adapt rapidly to keep pace with the evolving landscape

of fraud. It's essential for these tools to stay ahead, ensuring they remain effective and resilient in the face of new and sophisticated fraudulent tactics.

Empowering Fraud Detection: Adapting to Dynamic Threats

In the ever-evolving landscape of financial transactions, fraudsters are becoming increasingly sophisticated, necessitating robust fraud detection tools to safeguard individuals and institutions. Plastic card fraud, in particular, has witnessed a surge, prompting the need for advanced technologies that can adapt to the dynamic nature of fraudulent activities.

Fraud detection tools play a crucial role in identifying and preventing various forms of fraudulent transactions, including unauthorized access, identity theft, and cross-border scams. These tools employ advanced algorithms and machine learning techniques to analyze patterns, detect anomalies, and assess risk factors associated with financial activities.Explore the complete Scam Checker Tool on HuntScammers Scam Checker Tool.

As technology evolves, so do the tactics of fraudsters. The rise of contactless payments, mobile transactions, and all-in-one cards introduces new challenges for fraud detection. Consequently, the criteria for effective fraud detection tools are subject to constant change, requiring agile solutions that can keep pace with emerging scam activities.

Continuous innovation in fraud detection tools is paramount to staying ahead of cybercriminals. Real-time monitoring, behavioral analytics, and adaptive learning mechanisms are crucial components of an effective fraud prevention strategy. Institutions must invest in cutting-edge technologies to fortify their defenses and protect users from falling victim to plastic card fraud.

As financial landscapes continue to transform, the collaboration between technology developers, financial institutions, and regulatory bodies becomes pivotal in devising comprehensive and adaptive solutions. The goal is not only to detect and prevent fraud but also to anticipate and counteract the evolving tactics employed by fraudsters.

In this dynamic environment, the synergy between technological advancements and proactive security measures becomes the cornerstone of a resilient defense against plastic card fraud. The continuous enhancement of fraud detection tools ensures a safer financial ecosystem for consumers and businesses alike.