Debit Card Scam

Debit card scams involve fraudsters leveraging stolen or counterfeit debit cards to access funds or make

purchases directly from the victim's account. Sometimes, using purloined personal details, these

criminals apply for and obtain a new debit card under the victim's identity. In other instances, they

employ sophisticated devices to capture a card's data, creating a duplicate to illicitly procure goods

or extract cash. Such scams can lead to significant financial ramifications for the unsuspecting

individual. It's crucial to recognize potential risks and implement protective measures to safeguard

one's financial assets.

Spotting Debit Card Fraud

- Stay alert to unsolicited communications, whether emails or calls, that ask for personal financial details like card or bank account numbers.

- Regularly monitor your debit card transactions. Immediately flag any unfamiliar charges or withdrawals.

- For online transactions, ensure you're on a secure website and safeguard your PINs and passwords.

- Regularly assess your credit report to identify any unauthorized activity and promptly challenge any discrepancies.

- When shopping online, consider using established payment platforms like PayPal or Apple Pay for added security.

- Stay skeptical of overly attractive offers, like unbelievable discounts or freebies that require card details.

- Exercise caution with messages claiming to be from banks or financial institutions. Always verify with the institution before acting.

- Consistently review your bank and card statements for irregularities.

- Stay cautious of propositions demanding upfront payments or sharing of personal information.

- Use robust passwords for your accounts, update them regularly, and never use the same password for multiple platforms.

Strategies to Shield Against Debit Card Fraud

- Regularly inspect your account activities to detect any unauthorized or suspicious transactions.

- Establish robust passwords for your banking apps and websites. Refrain from sharing these with anyone.

- Avoid accessing sensitive financial accounts on public Wi-Fi networks as they might be insecure.

- Utilize debit cards with chip technology. They provide enhanced security compared to magnetic stripe cards.

- Activate instant notifications or alerts for your card transactions to keep track and spot anomalies.

- Guard your card details diligently. Never disclose your PIN or CVV to anyone.

- Be critical of emails asking for bank or card details, even if they appear genuine, to avoid phishing traps.

Understanding Debit Card Fraud Varieties:

- Card Skimming:

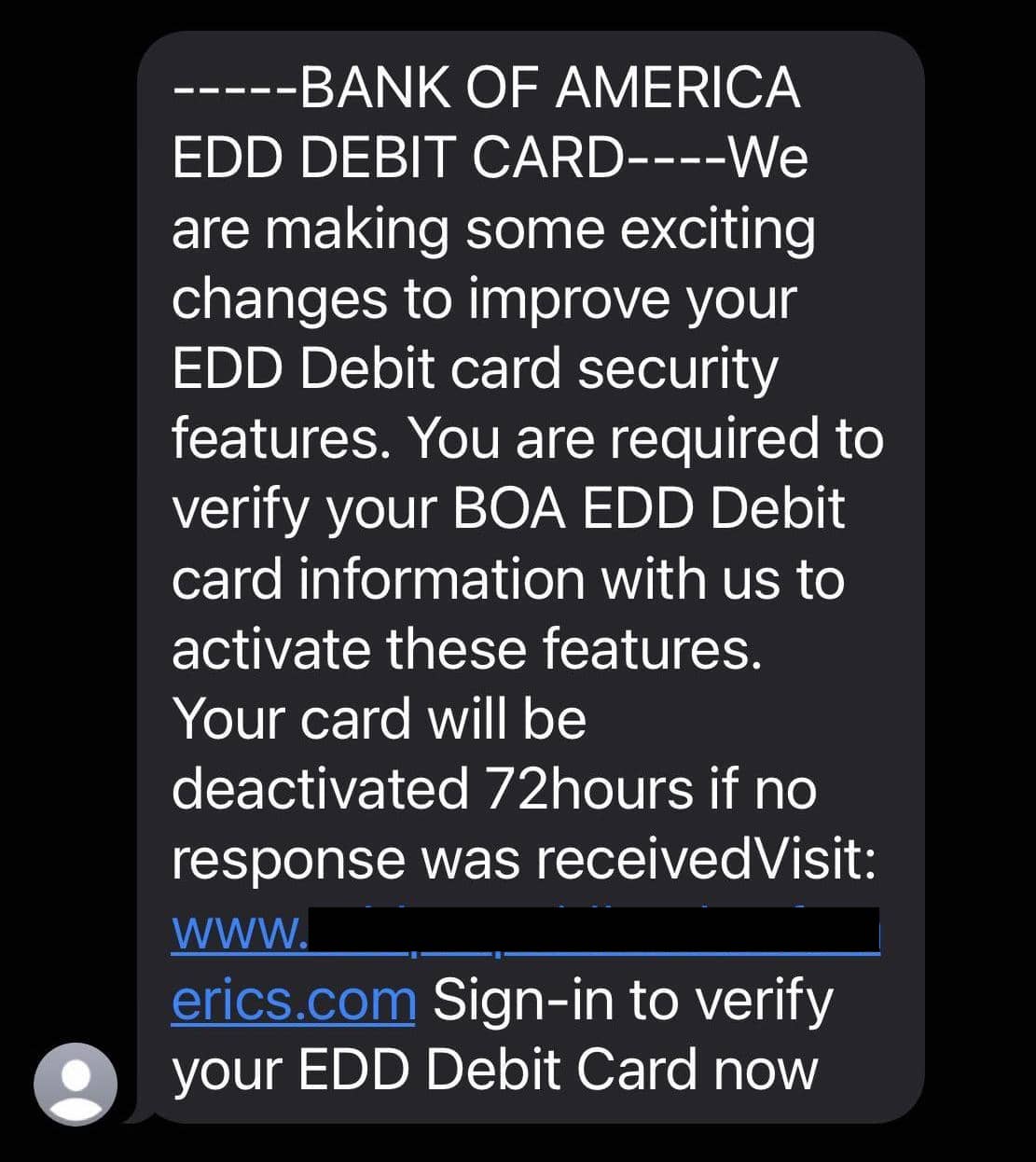

This entails the unauthorized installation of devices on ATMs or sale points to illicitly capture card details. - Phishing:

Fraudsters send deceptive emails or messages masquerading as trusted entities to trick users into divulging sensitive details. - Card Duplication:

Here, criminals produce a counterfeit card using stolen card details, often with altered expiry dates and PINs. - ATM Skimming:

Similar to card skimming but specifically targeting ATMs to steal card data. - Shoulder Surfing:

Thieves physically observe victims as they input their card or PIN details, often at ATMs or sale counters. - False Applications:

Criminals use stolen or fake identity proofs to apply for new debit cards, subsequently accessing the victim's bank funds.

Being proactive about security and staying informed can greatly reduce the risk of falling prey to debit card fraud. Always prioritize your financial safety both online and offline.

Debit card fraud occurs when criminals gain unauthorized access to your card details or PIN, enabling them to infiltrate your bank accounts and illicitly siphon off funds. Multiple tactics facilitate such scams, with skimming and phishing being predominant. Skimming captures data from a debit card's magnetic stripe, which fraudsters then use for unauthorized transactions. Phishing, on the other hand, tricks individuals into divulging their card details through deceptive communications, often masquerading as official emails or messages. With the rise of digital banking and online shopping, staying vigilant and informed is essential to thwart potential threats and protect your financial well-being.

How do hackers use your debit card ?

Criminals, once armed with your debit card details, can execute unauthorized transactions or drain funds from your bank account. They have the capability to fabricate fake cards using your data or even breach other personal accounts. What's more, they can potentially retrieve personal details linked to your card, including your address, contact number, Social Security number, and date of birth. This not only jeopardizes your financial security but also puts your identity at risk, emphasizing the importance of stringent measures to protect your card details.

how do bank investigate debit card scams ?

Upon suspicion of a debit card scam, financial institutions usually initiate a comprehensive examination of the customer's transaction records and account activities. They might collaborate with law enforcement agencies, sharing insights and aiding in the inquiry. To verify the legitimacy of a particular transaction, the bank might reach out to the concerned merchant. Additionally, the cardholder might be contacted to validate specific transaction details and to ascertain if they have fallen prey to fraud. As a preventive measure, the bank often takes the initiative to safeguard the cardholder by freezing the compromised account and providing them with a newly issued card, accompanied by a distinct account number.

Proactive Steps to Shield Yourself from Debit Card Scams Offline

- Periodically scrutinize your bank and credit card statements to detect any anomalous transactions.

- Safeguard your PIN and never disclose your debit card details to anyone, regardless of their claim.

- Stay informed about prevalent debit card scams and the best practices to fend them off.

- Activate fraud notification services with your banking institution or card issuer.

- Exercise caution at ATMs or while swiping your card at outlets – be mindful of eavesdroppers or suspicious devices.

- When shopping online, ensure you're on a secure and trusted network.

- Refrain from saving your debit card details on ecommerce platforms or applications.

- Be wary of unsolicited emails or messages, and avoid clicking on dubious links they contain.

- Equip your devices with the latest anti-virus and malware protection software, ensuring they are updated routinely.

- For online transactions or banking, avoid public Wi-Fi connections; opt for trusted and secure networks.

Digital Safeguards Against Debit Card Scams:

- Ensure you never disclose your debit card credentials, even if the request seems genuine.

- Safeguard your debit card's PIN diligently; it's confidential and shouldn't be shared.

- Proactively review your bank statements and look out for unfamiliar transactions that might suggest foul play.

- Enlist for instant alerts, be it via email or text, to be immediately informed of any dubious activities linked to your debit card.

- Ensure you conduct transactions only on legitimate, secure websites, especially while shopping online.

- Exercise discretion and vigilance when entering your PIN, even in digital spaces, as keyloggers or hidden cameras might be at play.

- To add an extra layer of security, consider opting for virtual debit card numbers for online transactions.

- Embrace contactless payment methods, like NFC or QR codes, to minimize physical interactions.

- Regularly update and run anti-virus and anti-malware software on your devices to fend off potential threats.

- Stay wary and ignore unsolicited communications, be it emails or messages, especially those soliciting your card details.