Atm Skimming Scam

A type of fraud which occurs when an ATM is compromised by a skimming device, a card reader which can be unrecognizable to look like a part of the machine. The card reader saves the users' card number and pin code, which is then replicated into a counterfeit copy for theft.

UNDERSTANDING ATM SKIMMING SCAMS

ATM skimming scams involve illicit devices, often undetectable by ATM users, that collect data from users' cards. These devices capture information from the card's magnetic strip, which can then be replicated onto counterfeit cards for fraudulent use.

OPERATION OF ATM SKIMMING

ATM skimming essentially involves stealing card identity. Fraudsters place electronic devices, often undetectable, over legitimate ATM card slots to capture user information. Additionally, they employ hidden cameras or false keypads to capture PIN inputs. As users unknowingly use these compromised ATMs, their data is recorded, making them vulnerable to financial theft.

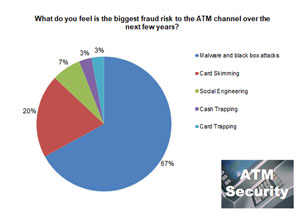

COMMON ATM ATTACKS AND SCHEMES

ATM attacks are sophisticated and varied. Some common types of ATM scams include:

Card Skimming: Where electronic data from cards is stolen, often leading to the production of counterfeit cards.

Card Trapping: Physical cards are trapped in the ATM machine, only to be retrieved by fraudsters once the user leaves.

Transaction Reversal Fraud (TRF): An error is created, making it appear as though cash hasn't been dispensed. The fraudster later collects this cash.

Cash Trapping: The cash is trapped within the ATM using a sleeve device, making it seem like the machine is malfunctioning. Once the user leaves, the trapped money is collected.

Vandalism: Forceful attempts to access the cash inside ATMs, including the use of explosives or forcibly removing the ATM.

Logical Attacks: These attacks involve electronic devices or malicious software to gain control over ATM dispensers for cash theft.

PROTECTIVE MEASURES AND SIGNS

Examine ATMs for any unusual or suspicious features, especially at the card insertion point or on the keypad.

Compare nearby ATMs before use to check for noticeable differences. Skimming devices often stand out when compared side by side with legitimate devices.

Cover the keypad while entering your PIN to block any hidden cameras or prying eyes.

Report any unusual ATM activities or transactions to the bank immediately.

It's essential to be alert and take protective measures. If something feels off or looks suspicious, trust your instincts and avoid using that particular ATM.