Bank Refund Scams

Why Sharing Personal Information Can Be Risky

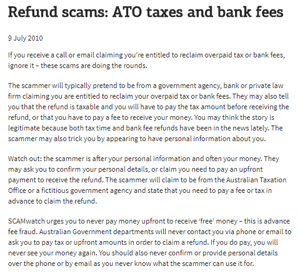

The digital age has brought with it a surge of scams. Scammers, equipped with modern communication tools, are constantly devising sophisticated strategies to trick unsuspecting victims. Although these con artists operate globally, many are based in African and European nations. Their ultimate goal is simple: to deceive people into parting with their money. A recent scam that has caught the attention of cybersecurity experts is the Bank refund scam.

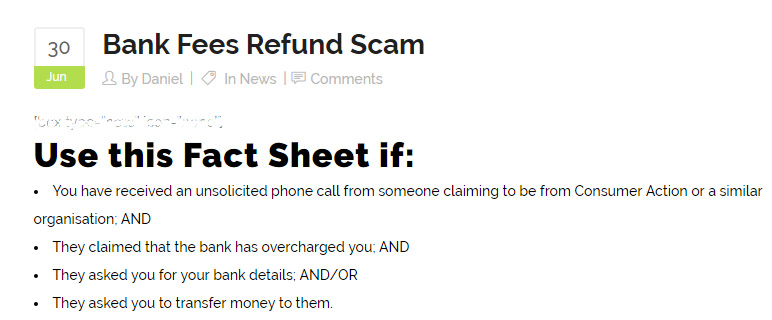

In these scams, fraudsters impersonate government officials, sending emails to unsuspecting individuals. They inform the recipients that they are eligible to reclaim overpaid taxes or bank fees. Subsequently, they request a minor deposit to release the larger refund. Such emails are usually crafted with a sense of urgency to coax the victim into acting swiftly.

Businesses and individuals alike have lost significant sums due to these scams. Scammers meticulously craft their emails to mimic legitimate government or banking correspondence. Their messages can be so convincing that victims are often threatened with immediate consequences if they don't pay the requested deposit. Once deceived, victims await refunds that never arrive. To add insult to injury, these scammers often ask for bank details under the guise of 'security verification', only to withdraw funds without permission.

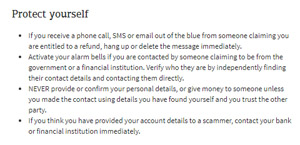

It's imperative for everyone to remain vigilant. Receiving unexpected emails about bank refunds should raise red flags. Before taking any action, individuals should consult with their financial institutions. Under no circumstances should bank details, passwords, or other personal information be shared. Legitimate institutions never request such details via email. If you come across such scams, reporting them to cybersecurity authorities can help in curbing these fraudulent activities.

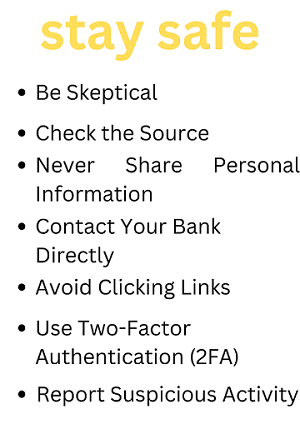

Tips to Stay Safe:

- Always be skeptical of unexpected emails promising refunds or requesting personal information.

- Contact your bank or financial institution directly if you're unsure about any correspondence.

- Never share personal or financial details through email.

- Use strong, unique passwords for all online accounts and change them regularly.

- Enable two-factor authentication wherever possible.