Tax Scams

Protect yourself from tax scams with our guide on recognizing and preventing fraudulent schemes. Explore common tactics used by scammers, learn about IRS-related risks, and discover strategies for maintaining financial security during tax season. Stay informed, stay vigilant, and safeguard your finances from the evolving landscape of tax fraud.

The Hijackers Will Cleverly Steal the Data

Millions of individuals engage in numerous financial transactions via diverse banking portals throughout the year, enhancing their social and economic standing. Typically, hackers infiltrate the websites of corporate entities to pilfer sensitive banking information, including usernames, passwords, account numbers, and ultimately, the name of the bank. Subsequently, armed with this stolen data, they gain access to the official website of a bank and input the purloined online username and password.

Millions of individuals engage in numerous financial transactions via diverse banking portals throughout the year, enhancing their social and economic standing. Typically, hackers infiltrate the websites of corporate entities to pilfer sensitive banking information, including usernames, passwords, account numbers, and ultimately, the name of the bank. Subsequently, armed with this stolen data, they gain access to the official website of a bank and input the purloined online username and password.

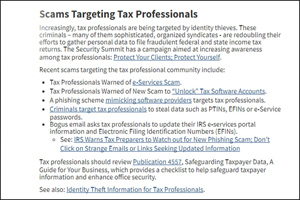

The Rising Threat of Tax Scams

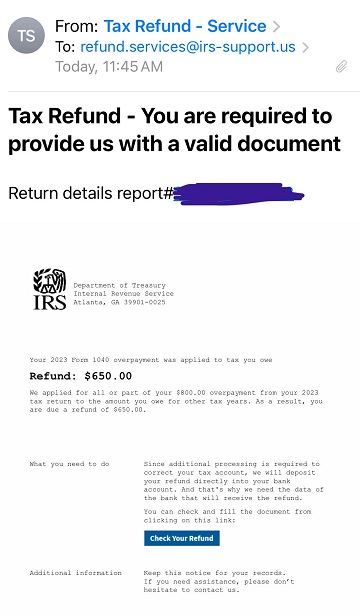

Upon gaining access, hackers exploit the situation by embezzling significant amounts from the targeted accounts and making a swift escape with the ill-gotten gains. A recent scam that has been gaining traction is the Tax scam. In this scheme, scammers pose as tax officials and send deceptive emails to customers, urging them to promptly file tax returns. The emails are crafted with a design and content that appears highly official. When recipients click on the email, they are automatically redirected to a fake website designed to mimic the official website of the income tax authority.

Corporate entities or individuals may unsuspectingly fall victim to these seemingly legitimate emails, leading them to pay substantial amounts to the scammers. Once the scammers have successfully siphoned off funds from the unsuspecting victims, they vanish without a trace.

Perils of Persisting Tax Scams: Staying Vigilant

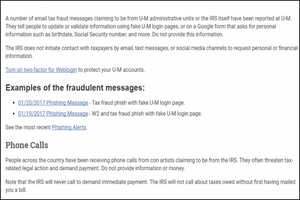

Despite efforts by tax authorities to curb these scamming activities, the menace persists. The revenue organization continues to receive complaints about the ongoing "Dirty Dozen Scams," creating a challenge for effective control. Perpetrators, operating from various countries, gather personal details of numerous legitimate taxpayers. They then send illicit emails to these taxpayers, urging immediate tax payment under the threat of severe consequences from the authorities.

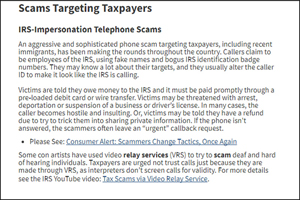

The crafted words, sentences, and phrases in these scam emails appear extremely official, leading unsuspecting taxpayers to pay significant sums into the scammers' accounts. The professional scammers often masquerade as high-ranking officials in the income tax department, going to great lengths to make urgent calls to innocent taxpayers, pressuring them to deposit money immediately.

Tax Refund? scam

Taxpayers should never respond to such scam emails without verifying their legitimacy. It is essential to check the authenticity of the communication before taking any action. Scammers employ various tactics, including threats, to swindle hard-earned money from taxpayers. Individuals and corporate entities, particularly those paying substantial taxes at the end of the financial year, should refrain from sharing any personal or financial details and avoid responding to scam emails or phone calls. Instead, they should promptly report instances of tax scams to the relevant authorities such as revenue or cybercrime units. While tax officials have taken serious actions against scammers in the past, identifying and apprehending scammers operating from different locations and countries remains a formidable challenge for tax authorities.

Perils of Persisting Tax Scams: Staying Vigilant

Despite efforts by tax authorities to curb these scamming activities, the menace persists. The revenue organization continues to receive complaints about the ongoing "Dirty Dozen Scams," creating a challenge for effective control. Perpetrators, operating from various countries, gather personal details of numerous legitimate taxpayers. They then send illicit emails to these taxpayers, urging immediate tax payment under the threat of severe consequences from the authorities.

The crafted words, sentences, and phrases in these scam emails appear extremely official, leading unsuspecting taxpayers to pay significant sums into the scammers' accounts. The professional scammers often masquerade as high-ranking officials in the income tax department, going to great lengths to make urgent calls to innocent taxpayers, pressuring them to deposit money immediately.

Taxpayers should never respond to such scam emails without verifying their legitimacy. It is essential to check the authenticity of the communication before taking any action. Scammers employ various tactics, including threats, to swindle hard-earned money from taxpayers. Individuals and corporate entities, particularly those paying substantial taxes at the end of the financial year, should refrain from sharing any personal or financial details and avoid responding to scam emails or phone calls. Instead, they should promptly report instances of tax scams to the relevant authorities such as revenue or cybercrime units. While tax officials have taken serious actions against scammers in the past, identifying and apprehending scammers operating from different locations and countries remains a formidable challenge for tax authorities.

Perils of Persisting Tax Scams: Staying Vigilant

- Despite efforts by tax authorities to curb these scamming activities, the menace persists. The revenue organization continues to receive complaints about the ongoing "Dirty Dozen Scams," creating a challenge for effective control.

- Perpetrators, operating from various countries, gather personal details of numerous legitimate taxpayers. They then send illicit emails to these taxpayers, urging immediate tax payment under the threat of severe consequences from the authorities.

- The crafted words, sentences, and phrases in these scam emails appear extremely official, leading unsuspecting taxpayers to pay significant sums into the scammers' accounts.

- The professional scammers often masquerade as high-ranking officials in the income tax department, going to great lengths to make urgent calls to innocent taxpayers, pressuring them to deposit money immediately.

- Taxpayers should never respond to such scam emails without verifying their legitimacy. It is essential to check the authenticity of the communication before taking any action.

- Scammers employ various tactics, including threats, to swindle hard-earned money from taxpayers.

- Individuals and corporate entities, particularly those paying substantial taxes at the end of the financial year, should refrain from sharing any personal or financial details and avoid responding to scam emails or phone calls.

- Instead, they should promptly report instances of tax scams to the relevant authorities such as revenue or cybercrime units.

- While tax officials have taken serious actions against scammers in the past, identifying and apprehending scammers operating from different locations and countries remains a formidable challenge for tax authorities.